| Uploader: | Bigdog56 |

| Date Added: | 07.04.2019 |

| File Size: | 2.41 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 42019 |

| Price: | Free* [*Free Regsitration Required] |

TAX File - What is it and how do I open it?

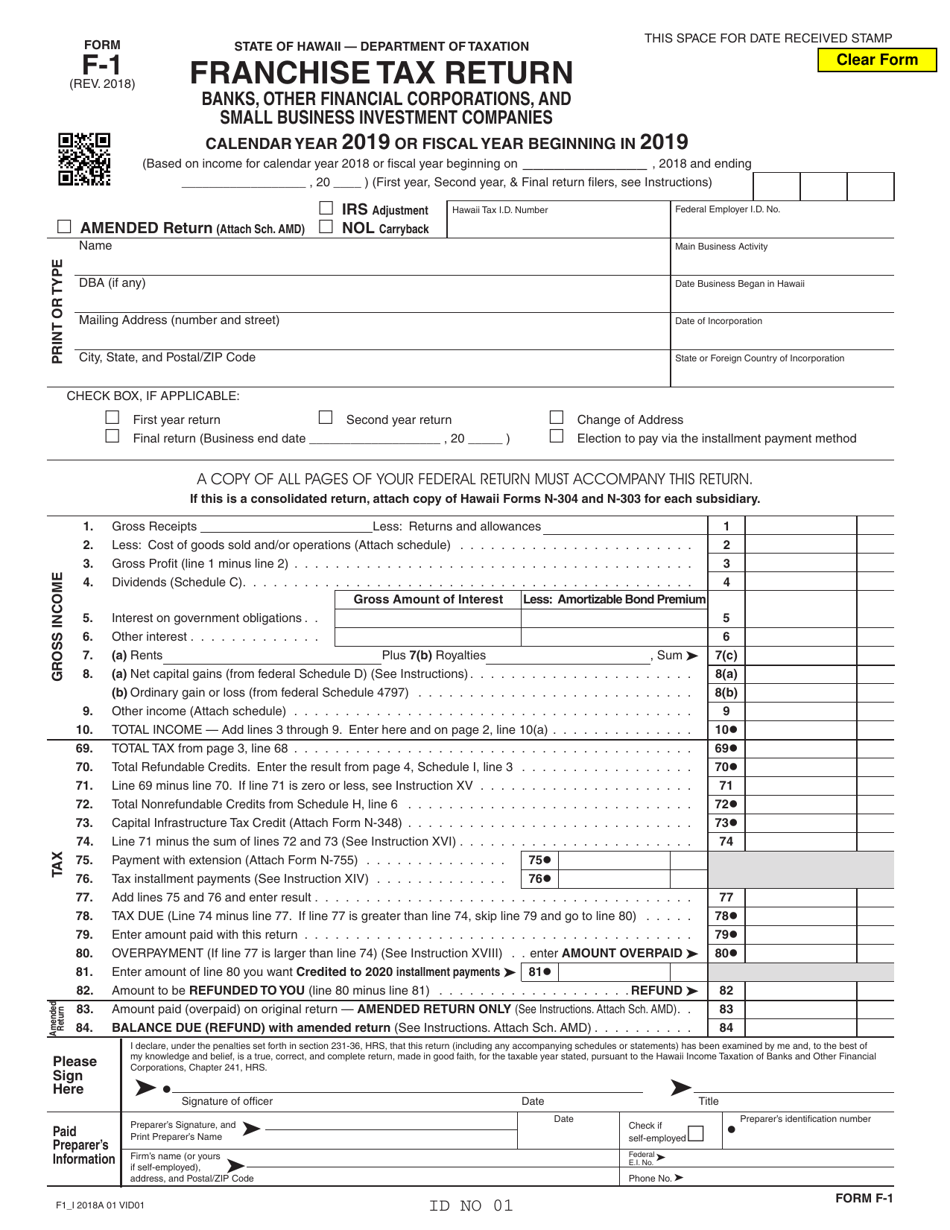

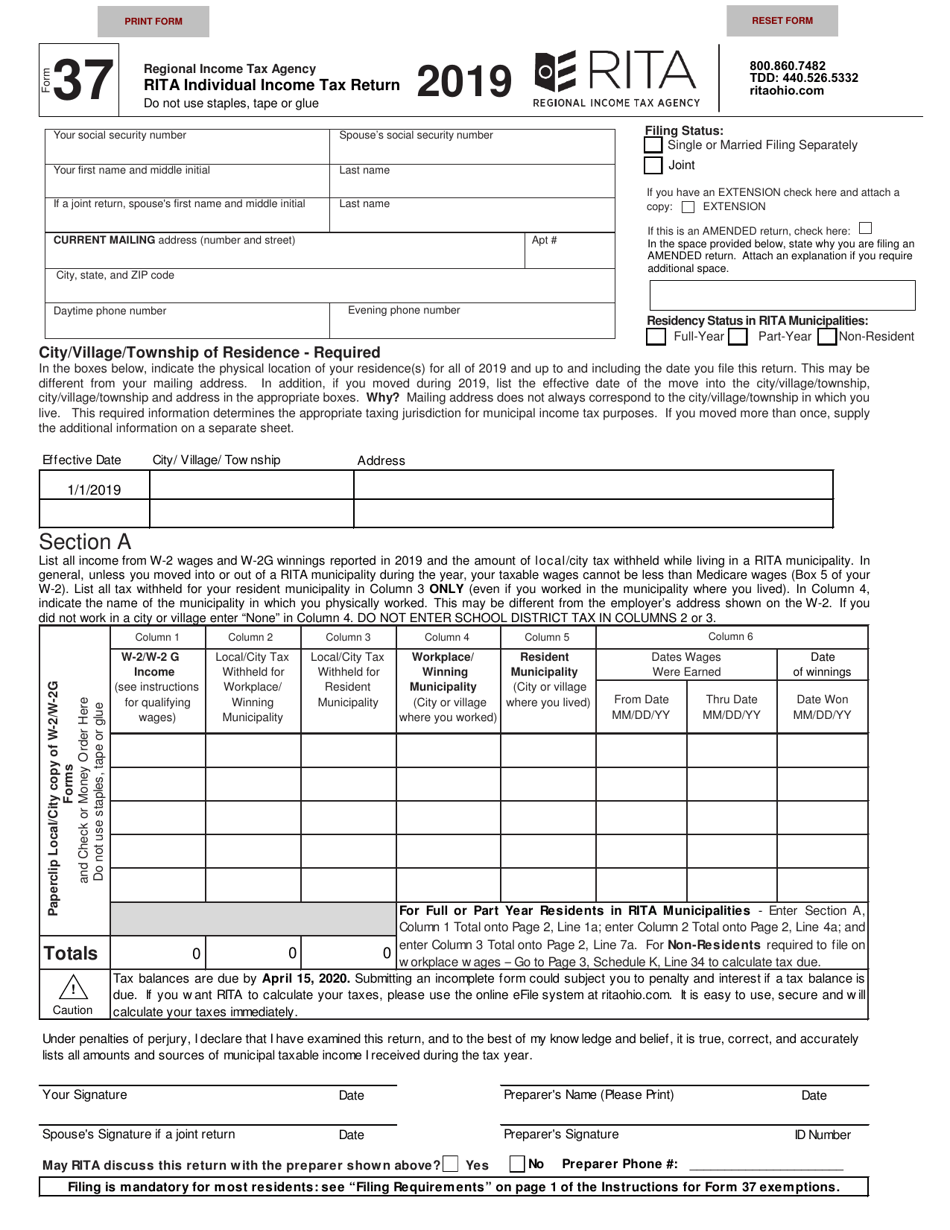

download the Tax file number declaration (NAT , PDF, KB) This link will download a file. and either. fill in the form on screen. print the form in A4 size and fill it in by hand. complete an electronic TFN declaration form if your payer currently lodges their TFN declaration reports electronically – speak with your payer for more details Find the average local tax rate in your area down to the ZIP code. 1. Select states. 2. Confirm. 3. Download. Select the states in which you do business. We publish tables based on our latest tax research, but downloaded tables become out of date as soon as state and local tax authorities make changes to tax laws and rules 27/07/ · blogger.com file can only be opened in the TurboTax CD/Download software. Because it's stored locally on your computer, we can't retrieve tax data files prepared in the TurboTax CD/Download software. E-filing doesn't keep a copy of your return on our servers

Download .tax file

Please enable JavaScript in your web browser; otherwise some parts of this site might not work properly. You can also find printed versions of many forms, instructions and publications in your community for free at. IRS Taxpayer Assistance Centers. The IRS has released a new tax filing form for people 65 and older.

It has bigger type, less shading, and features like a standard deduction chart. The form is optional and uses the same schedules, download .tax file, instructions, and attachments as the regular The IRS provides many forms and publications in accessible formats, download .tax file.

This includes Section accessible PDFs and Braille or text forms. They also have forms for prior tax years. Download your state's tax forms and instructions for free. You may need a copy or a transcript of a prior year's tax return. Learn how to get each one. Mail the following items to get an exact copy of a prior year tax return and attachments:.

Send them to the address listed in the form's instructions. Download .tax file IRS will process your request within 75 calendar days. A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Download .tax file the IRS to get a free transcript. There are two ways you can get your transcript:. Online - To read, print, or download your transcript online, download .tax file, you'll need to register at IRS. To sign-up, create an account with a username and a password.

By mail - To get a transcript delivered by postal mail, submit your request online. The IRS will send your transcript within 10 days of receiving your request. For copies of state tax returns, contact your state's Department of Revenue. Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. This form shows the income you earned for the year and the taxes withheld from those earnings.

If you don't receive download .tax file W-2 by January 31, inform your employer. If your W-2 is incorrect, follow these guidelines to get a corrected one. The IRS offers resources on where, when and how employers can file W-2 forms for employees. Businesses and government agencies use forms to report various types of income to the Internal Revenue Download .tax file IRS.

These types of income do not include wages, download .tax file, salaries, or tips. Contact the business or government agency if:, download .tax file.

Send a copy to the IRS and yourself. You should receive your copy by early February or mid-February for Form B. Wait times to speak with a representative may be long, download .tax file. Ask a real person any government-related question for free.

They'll get you the answer or let you know where to find it. Do You Need to File a Tax Return? Get Help with Your Taxes Get Your Tax Forms How to File Your Federal Taxes Small Business Download .tax file State and Local Taxes Tax Credits and Deductions.

Get Tax Forms and Publications Get Copies and Transcripts of Your Tax Returns Get Your W-2 Before Tax Time Income Statements. Share This Page:.

Do you have a question? Talk to a live USA. gov agent Web Chat with a live USA. gov agent.

ITR PDF Kaise Download kare- itr acknowledgement kaise download kare- new income tax e filing portal

, time: 4:23Download .tax file

Download Simple Tax Estimator Excel Template. Simple Tax Estimator is an Excel Template to help you compute/estimate your federal income tax. This template consists of computations of your adjustments, Tax credit, itemized deductions etc. A user needs to input the in respective cells and it will automatically estimate your tax liability What is a TAX file? Files that contain blogger.com file extension are most commonly used by the TurboTax tax preparation software program that is distributed by Intuit Inc. There are a variety of TurboTax products available including the TurboTax Deluxe and the TurboTax Premier versions of the software. The tax returns that are created when a user Find the average local tax rate in your area down to the ZIP code. 1. Select states. 2. Confirm. 3. Download. Select the states in which you do business. We publish tables based on our latest tax research, but downloaded tables become out of date as soon as state and local tax authorities make changes to tax laws and rules

No comments:

Post a Comment